From Coins to 25%, 1.10k+ In Equity At 18

Below is my life story from a financial perspective. Specifically how I started from collecting coins at age of 5 and then reached 1.10K+ in equity at 18 in bear market.

This is my personal story. None of it is financial advice, if it wasn't obvious by now. Many people have asked me to include what stocks did I buy, what strategy did I use. Giving financial advice without proper certifications, which I neither have nor want, is a crime according to the government. Also I don't want to reveal my cards. Additionally the document itself is licensed under CC-BY-NC-SA, which also includes a "No Warranty" clause.

The "From Coins" in title is a double-entrede. First one means that I started by collecting coins at 5. Second can imply that I started with very little resources, just coins, before reaching 1.10K+ in equity at 18.

Table Of Contents

- Collecting Coins, Notes; Buying Them At Premium From beggars(5- 6)

- Collecting, Trading Stationery; Facilating 2 Business Transactions Worth Lakhs(9 - 11)

- Earning 700 through Gambling, Microtasks, Referrals(12.5 - 13.5)

- Making Making $13 in Trading, $105 in Demo in Crypto Without Any Investment (13.5 - 15)

- Reaching ₹16,000 Through in-game Microtransactions, Surviving Muggings, Bad Debts (14 - 15)

- Trading Equities Using Investopedia Simulator (15.5 - 16)

- Reaching 10% in Equity in 6 Months Using My Father's Demat Account (16 - 18)

- Teaching Finance to New Classmates, Saving them from further losses (17)

- Experimenting with Indirect Tea Sales In Fairs, Parks (17)

- Starting Equity With My Own Account and Reaching 25% (18)

- Becoming Self Made Equity Lakhpati In Bear Market, (18.5)

- Applying Secured Credit Card; Trying Various Methods to Increase Credit Score (18 - 19)

- Becoming A Double Equity Lakhpati (19)

- Discussions On My Strategy

Collecting Coins, Notes; Buying Them at Premium From Beggars(5- 6)

This is probably the hobby that paved the way for my interest in finance. While I mostly collected exotic Indian coins, I also did have some paper notes, and foreign currencies too.

Most of my coins came from buying it from beggars at a price higher than their face value.

This hobby was kinda expensive and required traveling to some potentially unsafe places. It was impossible for 5 year old me to sustain it, so I soon at age 6, I left it. Still 13 years later, I still have those notes secured in a good condition.

Below is the picture of notes from my collection taken 13 years later, at time of writing the article. 3x One Rupee and 1x of two rupees. Placed on a paper with my name as a "proof".

Collecting, Trading Stationery, Facilitating Business Transactions Worth Lakhs(9 - 11)

I started collecting stationery at age of 9. By the age of 10, I had started taking my stationery collection seriously. I also introduced this hobby to my classmates, and it spread like fire. I also started trading stationery with them. I named this act "Soada", which is Punjabi word for "deal". I mostly traded stationery for non stationery items including food, money and others. I kept a written, signed bill of each item traded for just in case. I also introduced written form of communication in form of paper balls letters with some obscure words.

Some of my most notable trades were soft drink, chips nuts, and which in return, I got two pocket sized Oxford dictionaries. Cash, listening to stories of a classmate's father stationery shop from which I got an obscure sharpener from her. Pack 50 pens, 2 Rupee, each from a village student for cash. Mathematics table, formula notebook, which I wrote myself, for which I got 5 sharpeners in return. An imported chocolate for in return for 7 sharpeners. A small carton of juice(10 rupees) for mechanical pencil(worth 15 new) from a female classmate.

I was specially fond of pencil sharpeners and pens. I had 97

pencil sharpeners, 70+ pens, 30+ erasers. Thefts were pretty

common too, so I had "secret pockets" in my bags, coats which were

carved out using sharpener blade. I also managed to convince some

thieves to not steal my items, else I will complain them to our teacher, A, who considered me as her "favorite student" and gave me Smart and Cool :smile:

on official report card, and keys to her personal locker in staffroom, exemption from makeup(skin whitening powder, lipstick), because I am already pale, and allowing me to wear my own jacket function and allowing me to wear my own jacket. While I had access to A's personal locker, I never used that for my personal storage or even requested her for that.

There were also some ideological differences. For example, one rival turned trading partner collected pencil leads from wooden pencils by repeatedly sharpening it, which I, and A both, found valueless and waste but we didn't object.

Another one was with many others who were so keen on displaying their collections publicly to almost everyone but I was opposed to this. Due to concerns of theft and whole class already knew this. But some show off was also necessary as form of advertising, so I kept my bragging tendencies to limited circle. I used to say, Why should I bend and look down , laugh on others instead of making others look up and they will notice automatically.

In addition to that, we did many other things including Pen fighting[^1], "experiments" with stationery, writing short reference books, throwing our stationery out of window on the porch and then rolling them down through water pressure. The one who managed to do this could keep all of them.

I stopped this hobby at age of 11 because it was getting way too expensive, my step mother had discovered my collection thieves had left the school, our school was getting strict to the point that they confiscated my cash, expensive stationery. Though I got them back shortly afterwards.

And I also became favorite student of another teacher, C. She appointed me as discipline manager, time tracker for her class. I also helped her by facilating a profitable business deal with my father. And another seperate business deal with a classmate, BD, who would later become a bad debtor of me of 200 at 14. Both deals were worth in Lakhs and involed purchasing an asset from them.

I also had started focusing on programming and later finance. Though my stationery didn't go waste. I personally donated many to poor students, including poor non-school friends, who passed an oral test of basic mathematics or English.

Earning 700 Through Gambling, Microtasks, Referrals(12.5 - 13.5)

At the age of 12.5, I created a Paytm account with Mini KYC, from my father's documents, with his consent obviously. And started earning through referrals, micro tasks, quizzes and some real money gaming.

I didn't really do real money gaming, basically gambling, much as I knew that I often lost, except in one game in which I managed to earn around hundred rupees. I didn't do sports betting, rummy, poker as I didn't have enough knowledge, neither desire to gain it.

I must have earned a total 600-700 rupees overall, without any investment, but I then just stopped as the work to reward ratio was too low. But for me, the biggest feeling was earning something. I still remember that I playfully bantered with my classmates that I have already started earning, have more cash in my wallet than them, who had none.

Making $13 in Trading, $105 in Demo in Crypto Without Any Investment (13.5 - 15)

At the age of 14, after I gained working knowledge of block chain, cryptocurrencies and related fields, I started searching for ways to implement my knowledge. I came across a platform named Stormgain which had a scheme that would let you mine Bitcoin on their cloud platform for free. So I signed up there and started mining.

I was able to refer around 5 people in my a href="https://hstsethi.vercel.app/posts/lifestyle/lessons-learned-founding-internet-groups-memoir#telegram-group-telegram-15-150">Telegram Group, which increased my mining rate. Soon, I reached $10, the minimum withdraw limit, and withdrew my earnings to my trading account, there was no option to withdraw to bank account, crypto wallet. From that, I bought Matic USDT and made $13.

But sadly, I wasn’t able to withdraw the profit because I didn’t have legal documents, as I was a minor. After that, I just abandoned Stormgain, cryptocurrencies and started focusing more on programming, equities instead. Though still I did manage to make $105 profit in demo account.

Reaching ₹16,000 Through in-game Microtransactions, Surviving Muggings, Bad Debts (14 - 15)

As I shared in my previous article that why I am not a game developer and why I don’t play video games, I was safe from this “disease”. But many of my friends did, and they didn’t have much means to do in-game micro transactions as they were minors too.

I had already opened a mini KYC Paytm account at age 12.5 using my father’s documents, as I mentioned above, and had knowledge of these things so I did micro transactions on their behalf.

Most of micro transactions I did were in video game named Free Fire. I would buy a Google Play Gift card using my Paytm balance and then share code with them. Sometimes, I also did direct top ups using Codashop. And sometimes mobile recharge, interest-free small cash loans as well.

At the age of 13, BD requested me a cash loan during a school trip but I refused, as I had myself smuggled in a limited amount. Though one of my friend gave him, which he later regreted, as he could not make purchases like me. At the age of 14, during Covid lockdown, I was reached out by BD for doing in-game microtransactions for him. I was skeptical a bit, as he used to boast about his foreign wealth, supportive parents, then why would he ask me, but I complied. Later I stopped doing microtransactions altogether, because he was not returning money. Since the school was closed, that gave him an advantage. Else if we met in school, he might even hand me over cash.

I managed recovered some, but then I stopped going to his home as I was spending more in fuel. I had already earned lot of profit by arranging business deal between BD and my father at age of 11, so I gave up with bad debt of 200 Rupees. He nonetheless shared my number with a 23 year old, self-proclaimed gangster man to intimidate me. As I saw his Instagram profile, I saw he had a group photo with one of my friend. If I wanted I could discuss that with my friend, but I myself utilized an emotional approach. I falsely claimed that my parents check my transaction history, and managed to make him admit that BD owes me 200. Which served me as a solid proof in future if he denies, though I had already stopped.

Later at age 15, I was approached by an old friend, NC, who proved to be much more profitable, and zero bad debts. I continued with him till the age of 16 before I stopped altogether forever. Below is a chat screenshot NC. Translation NC: Hello, Harshit. Me: Yeah. NC: Harshit? Me: Yeah say. NC: Russian one. Me(msg deleted in screenshot): Lol but I have now left their group. He: Do you have money in Paytm? 700? Me: Yes He: Okay I will send you a number, send it there. Me: Okay, send.

At 15 as well, I was contacted by another classmate, for same reason. I did some transactions for him but later I lost 300 to him in bad debt. He wanted to do a big in-game transaction, of which he deposited only that amount, but not my debt. But he got scammed by another shopkeeper who charged him 20% deposit fee. I said to him that it is too much, and I can do for cheaper, and refunded the amount to shopkeeper. But shopkeeper did not return it to him, instead did the top-up himself. I stopped doing microtransactions for him, as well, and never asked much or visited his home.

Since Paytm is not a traditional bank, I couldn’t go to a bank to get

money deposited. So, I would have to walk long distances to some random mobile recharge shops,

and later a friend, who would take cash, commission from me and send to

my Paytm account. For this reason, I would charge some “commission”

too. Though my comission rate was not fixed. Many times I only got just enough for transaction charges, with no mention of comission at all, so I had to take advantage of economies of scale by doing bulk deposits. Due to it not being a traditional bank, once a credit worth 4,500 was freezed. I did not have UPI and my friend did an UPI payment. It stuck there for 5 months until suddenly, at age 15, it was credited after hours of verifications and talks with customer care. Later in 2024, The Reserve Bank of India (RBI) ordered the payments bank subsidiary of Paytm, to stop accepting fresh deposits in its accounts or popular wallets from March.

Source: Reuters. But I had long ago deleted my Paytm account, after unsucessfully requesting them for my transactions, profile data. I also had long created a minor account in an actual bank with debit card, monthly statements on email, and cash deposit in both ATM, in-person, so it did not affect me.

My opening balance at age 14 was around 1,500 rupees, but my closing balance, at the end of age 15, was around 16,000 rupees. of it some were my personal deposits as well. While I did loose around 500 as bad debts to two of my friends, I then stopped doing transactions for them. Overall, it was fun and profitable!

A boy(SM) who was 2 year older than me, 16, but shorter, had discovered that I often carried cash to get deposited from my friend. He once tried to mug me near that place by blocking my way and an unsucessfull arm bar. He was accompanied with another 16 year old boy who did not interfere much. After 5 minutes of resistance, I managed to push him down and run away. SM tried to grab my backpack to stop me from running, but he ended up stumbling again after the strap tore away. I did not give him any money, and he afterwards never dared to mess with me.

Trading Equities Using Investopedia Simulator (15.5 - 16)

Even though it was a demo account, I played safe and only bought securities which I would feel confident buying from my real money. I also bought some cryptocurrencies including Dogecoin, Ethererum, Bitcoin, but my main focus was on equities.

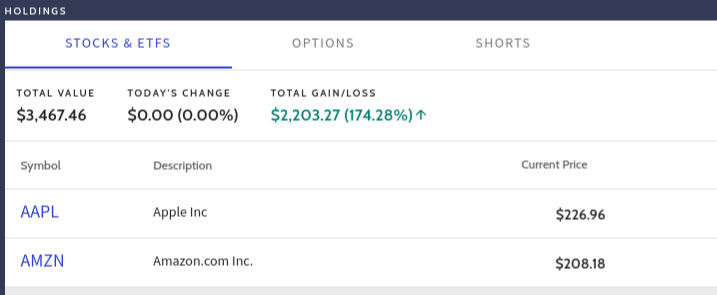

As of 2024-11-10, My abandoned account have 174 % profit, but it’s just a demo account, so I can’t really withdraw it.

Starting Equity Trading Using My Father’s Account (16 - 18)

At the age of 16, I finally managed to convince my father to open a demat account for me. Earlier he was using multiple excuses including how he lost so much money, “what if step mother discovered this”, “focus on studies”, "invest in gold", and more. But when I showed him my demo account and demonstrated my knowledge, he agreed. After extensive research, I choose Zerodha as my broker, because it was a discount broker, that charges less fees than full-service ones. My father had initially opened an account on a full-service broker, but after I explained him charges associated with such brokers, he let me open account at Zerodha, using his documents.

Within six months, I managed to earn 10% profit by investing my savings into low expense ratio ETfs and few individual stocks. For reference, not all ETFs are Index Funds, which track an entire index as whole. The ETFs that I invested in had cherry-picked holdings from a specific index.

During this age, I also started learning about XMR(Monero). Specifically, it's algorithm and implementation. I experiminted with it's testnet network, mining etc. As screenshot below shows, I managed to get collect 10 XMR(Testnet).

At age of 17, I started learning about various equity related strategies through paper trading, backtracking, using a stock screener, refined mine one, moved from ETFs to individual stocks, because I enjoyed researching different sectors, companies, and also for higher returns. Also reached around 16% profit.

Teaching Finance to New Classmates, Saving them from further losses (17)

At the age of 17, after lot of explanations, fearmongering by me, one of obsessed classmate, from C-2C, created a demat account using his parents documents, just 3 months before final exams. He took accountancy homework very seriously, where I did not even care and was even basically exempt from it by teacher, allowed to only do examples. He wanted to pursue B. Com from Delhi University, one of most prestigious for business courses. Despite having reservations, he wasn't able to. Which makes what you will read further to be even more absurd.

He initially choose Groww and created account with his father's document, but I suggested him to switch to Zerodha, due to low expenses, and create account from someone with lower income tax slab rate, and he did. I had also gave him a rough idea of good blue chip stocks to invest in. He also took my advice, but ended up making a loss.

His first trade resulted in a loss. When he came to class the next day, he told me that he had accidentally sold it and will again buy it today. He then again did the same mistake.

The next day he came to class and offered to drop me back home, I refused but he then said he wants to talk about stock market, so I kinda agreed. In the mid way, he started sharing what had happened to him, accusing Zerodha to be a scam company etc. But he couldn't even tell how much loss he made on each trade. He simply told me the difference between his initial capital and current one, which he did using calculator after in my presence.

Then I went through his accounts myself, in his phone, and quickly found the error in the tradebook. While the tradebook is deep buried in console, and UI isn't that friendly, an investor ought to have knowledge of platform before starting. As I suspected, he was doing intraday trades using MSI instead of Cash and Carry(CNC). Due to which, he not only paid higher charges, but also suffered from market volatility. The first trade caused him a loss of around -500, the second he got slightly lucky and ended with ony -192 loss.

I then suggested him just to close his account. He said he will keep account just to check stock prices, but wouldn't trade. When I told him about AMC, he got shocked that expense also exists and then thanked me, asked me for account closure process. I directed him to Zerodha customer care, which he had around 20 minutes talk with. I didn't want to reveal my home location to him, so I told him to drop me at a common destination, and then I walked back home. Ultimately, even his offer to drop me didn't prove to be beneficial to me, as I had to walk significant distance.

So in the end, he suffered a total loss around -1,000 including 200 account opening charges, which was all preventable.

His fault was that he ignored the perquisites, and didn't do any research himself. The signs were clear: beta value was high, RSI was showing overbought and PE ratio was above 50. His first ever trade was done using real money, which you should never. Always start with paper trading. Despite being familar with financial ratios, balance sheet anysis from education, and doing thoussnds of questions on them, he did not even apply those concepts. He also didn't ask for my phone number, from me or anyone. All of our communication were in class. I could potentially help him earlier if he had messaged me. Though members of C-2A, biggest faction within class, congratulated me for "causing" his loss.

NC, one who requested me to do 700 rupees micro transaction, asked my advice after investing in an IPO. After I told him that the industry he invested in has almost total monopoly, he sold those shares at a minor loss. My advice was provetd to be true as the stock fell after just few months of IPO. I had gained this knowledge by actually spending my time in a shop concerning such industry. I was familiar with what customers demanded and what fear mongering shopkeepers used.

Experimenting with Indirect Tea Sales In Fairs, Parks (17)

I came up with this plan at 17. After I realized my previous startup plan about IOT, Real Time, Financial Info Device was economically unfeasible. So I later open-sourced it.

My plan was to basically sell pre-made tea in a thermos. In venues such as pen ground events such as fairs, or at parks. But not directly myself, but indirectly through a laborer on commission. commission being given on every sale.

Sales would be tracked through paper-cups used up. In rare cases, it can be bypassed if customer demands it in his utensil, such as water bottle. Payments would be in cash, or at my printed UPI QR code.

I would market it by roaming around in the area while drinking tea, which I do not consume normally.

To test this, I went to a such event in a cold December night with a tea in paper cup. I faced more staring than usual. Though on the bright side, many people also asked me that from where did I buy it. I simply told them truth that I brought it from my home. But this thing showed me that demand was actually there, and there was no competition.

But this idea was never implemented in practice. Firstly because it is hard to find a honest laborer. What if he ran away with thermos, what if he started his own thing, because the capital requirement is low. Other reasons included low margins, issues in keeping tea hot, safety issues.

I could also do it myself. But many factors stopped me. And I must admit that ego, cultural expectations were also one of them.

Starting Equity With My Own Account (18 - Present)

From just a day next to my eighteenth’s birthday, I started preparing for creating my demat account, because I knew that it would be a lengthy process. I started by applying for Permanent Account Number(PAN) card, which is necessary to create a bank and demat account. But due to some issues in my full name, I was not able to apply it online. Despite it being more expensive, and tedious than online, I still choose to apply offline by filling a form, as I knew this way was more forgiving. A month later, my PAN card got delivered to my home.

I went to bank with my father to get my account converted from a joint minor account to personal savings account. But a similar issue arised again, so I had to completely close old account, and create a personal single savings account. It also took around a week.

After that, I created my own demat account at Zerodha. Surprisingly, my account got activated within 48 hours but now I had to transfer equities from my father’s account to my account. It was again very lengthy process that involved creating account on CDSL website, waiting 48 hours for deository participant to approve, setting up beneficiary, verifying documents, but still I managed to do it on my own. Sadly, this wasn’t the end.

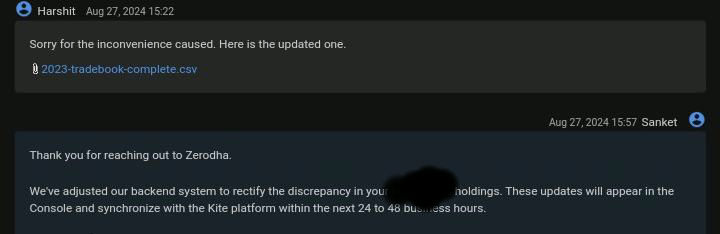

After the securities got transferred to my account, I faced yet another issue. The issue was that only number of shares were visible, but their book value wasn’t visible.

After researching on internet, I found that it’s a common thing. Now I had to manually enter the book value, date of purchase, amount of each share. I initially became a bit worried on how would I get that this data, as the shares were transferred from my father’s account. I went through bank statements, chat logs, screenshots and created a CSV file of all the transactions I could recover.

To ease up the process, I wrote a simple Python script to automatically calculate average price of stocks and append it to CSV. But this wasn’t enough. Not only the dataset was incomplete, but it also had some small differences than book value of shares which were caused by various charges including brokerage, tax.

Fortunately, when browsing through my father’s demat account, I found a way to export old trade history as CSV. I ran a modified version of my script and created a clean CSV file.

But still, some shares still had discrepancies. The UI and docs were extremely unhelpful too. I ended up sharing my CSV to customer support and they fixed my issue within 7 days. Interestingly, they also admitted that there were indeed issues in backend.

It took around 4 months in all this but after that I could enjoy the fruit of freedom, my efforts. Soon, I also reached 25% in equity

Edit:1 Some "readers" from a technical analysis community have been arguing me that I should have sold and rebought the shares, instead of transfering them, as transfering is a long process. Well, If I had did what that then I would have to pay additional tax, and also I would loose that 20%. If I had sold them, then I would not be sitting on 25% profit and would not be writing this article. Also they were telling me that I would not have to pay tax, as my income is low, but I was trading from my father account. If I had sold using his account, that would have caused tax liability, he would have to use ITR-2, a more complex tax form. I thought it would be obvious hence, I did not clarify it. < /p>

Edit2: Within a month of writing this article, I was able to double

my capital. I did this with combination of taking advantage of Largest Con of Corporate history

by Adani, as reported by Reuters even though I heard this news after closing of market,

different strategies and willpower. I am not going to hold Adani stock for a long time due to: extremely high PE; high equity to debt ratio; coal, cronyism etc. They, the readers mentioned in first

edit, used to say "A dip*** kid came here to flex his 25% profit on 35K

capital and how he saved on taxes ..." but I never cared much. If I had

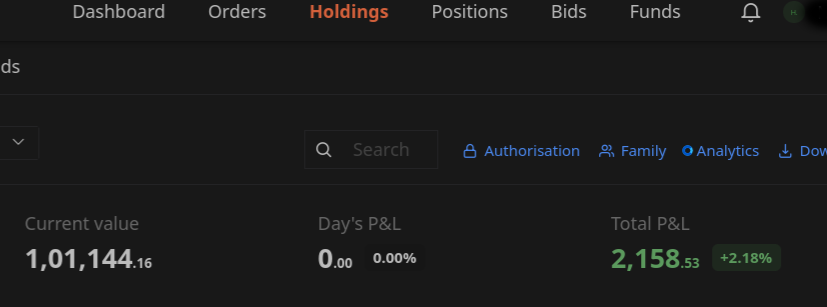

been arguing with them, I would have never reached here. Below is my P/L

as of 2024-12-18. The small red is due to a stock is due to a single

stock, but overall it's all green. I will just book profit and sell it

ASAP, in fact I have placed a sell order already.

Becoming Self Made Equity Lakhpati In Bear Market, 18

Lakhpati means someone who has more than 100k rupees. I used this word instead of millionarie because the later implies USD. I have now changed the title of this article to simply "1.10k+" to be more clear.

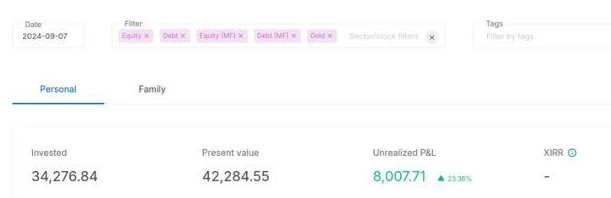

Despite the market conditions being bearish, Sensex down by 3,000 points, according to Times Of India. My profit % being down than earlier, 25, due to aggressive trading, I managed to reach my goal. It is an extremely difficult thing to reach this goal in bull run, but I did so that in Worst bear run since 29 years , as Reuters article linked below reports, and at age of 18, just 4 days before my first semester exams.

Edit 3: 2025-02-15. I am extremely happy to announce that I have become a Self made, Equity Lakhpati in the bear market, by the age of 18, by having investments worth 1,00,000 Rupees at market value.

But unfortunately, since today is Saturday, I can't do the trade today, but I have placed a limit order worth 9,000 which will get executed on Monday. I already have 92,000 so even if it doesn't become green that time, I would still be Lakhpati. So basically nothing can stop me. I will upload the screenshot on Tuesday, because I just can't control my laughter today and also after delivery so that people don't say I did an intraday trade.

Also it looks like my decision to not hold Adani was yet another right one. Currently Adani is down again, and it's due to coal as Times of India Reports. If I kept holding it, I would have not become a Lakhpati this soon.

Edit 4: 2025-02-17, turns out my another decision was correct, my premature celebration was not wrong. In the end, I had the last laughter, but it was not my last laughter. Not only my limit order got executed below the market price, but I am now sitting at 1% up in positions. I can technically sell it and be profitable, but I am going to wait for delivery. I have uploaded screenshot of positions on Linkedin.

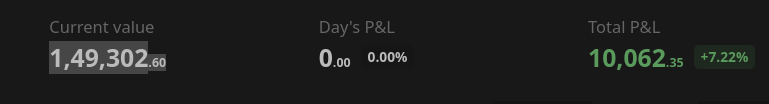

Edit 5: 2025-02-18. For those who like to keep a count, my yet another decision was correct. The market value of my portfolio is above 1L, even before opening of market, and below is a screenshot of my P/L as promised.

Edit 6: 2025-02-20, Adani stock is down again by 4.5% due to bribery charges by USA, as Times Of India reports. A bit of old news as I don’t consume news and I don’t have high expectations, unlike what high, artificially infalted, PE ratio of company says.

Edit 7: (2025-03-08) Despite the continued bear trend, I was able to take the trash out of my portfolio, free up capital. A limit sell order I had earlier placed has been executed. I did lot of mental calculations, even including transaction charges, managed my greed and set a value that will leave me with a net profit. I used the money from it, and some additional to invest in a good stock. Now even my investment value is more than1 Lakh. I didn't invest too much as I also have to pay college fee too. If I had set GTT high, it wouldn't be executed and I wouldn't be able to take advantage of current bear market. Now I also have one less company to worry about, and now my portfolio is above 1.10K.Applying Secured Credit Card; Trying Various Methods to Increase Credit Score (18 - 19)

My goal is to increase my credit score. I do not care of rewards, which often have a redemption fee as well. I do not care of fuel surrcharge waiver as well, as I pay with cash for it, hence avoiding the surrcharge at first place.

There are many ways to do it such as traditional loans, education loan, Buy Now Pay Later(BNPL), education loan and Credit Cards(CC). I choose CC route. But I also studied rest of them at age of 18, which I will be discussing below.

At the age of 18, I scored 865/9,000 In IPU CET BCA without any reservations or formal education, see my Linkedin for more info. But I could not go due to higher fees and living expenses. I could apply for education loan, and that could skyrocket my credit score even without CC. But it did not make sense to do so, neither financially, nor philosophically.

After leaving another offline university and accomodation, I ignored the social pressure and enrolled myself into a cheaper, online university. This university also had a “no cost”, EMI option using Grayquest. But I did not apply it for same reasons as above. Some of my peers here regreted after they realized that it was not really “no cost”. I told them they should have instead taken an educational loan from a tradional bank but it was too late.

I could also choose Buy Now Pay Later(BNPL) schemes. But Amazon BNPL has age restrictions of 21. Flipkart, which I do not even have account at, has lot of other additional expenses.

At the age of 18 as well, I could also get a secured, no-annual charges, CC, but I did not want to juggle multiple bank accounts. All of them required making a auto-renewing, Fixed Deposit(FD), in the associated bank. Which was often an unconvential bank like cooperative or small finance bank. I also could not have reached my goal of reaching 1L capital in equity by 18, which I did, if I had put my money in FD.

For example, the "Super.Money" App by Flipkart which relies on Utkarsh Small Finance bank, and also has mandatory contacts permission, and does not work on my degoogled-phone.

Some reputable banks, including my own, also offerred but again the same requirement. One somewhat reputable bank offered a good card but it has no branch near me, and it's mobile banking app does not work on my de-googled phone.

Shortly afterwards filling my first income tax returns at the age of 19, I got an unsecured CC offer from my current bank. But it had high annual fees, and was travel related, so I did not apply.

Instead, I created a FD with my current bank and started applying online. But due to some technical issue, I was not able to apply online. When I went to home branch, they said they have no CC team here and just ghosted me. I then took it by myself and directly emailed CC team, but they did pushed me to redo my KYC. Which I refused to do as I knew it was just a generic advice.

So I had to break my own principle of single bank account. I then tried opening an SBI savings account online, but that failed as well due to some legal documents error.

It took 3 hours in total but I managed to apply a secured CC, passbook(with all transactions printed) and a savings account at offline SBI branch. I had made it clear that I will only apply for a savings account, only if I can apply for the CC I want in this specific branch. I rejected their repeated offers for debit card, insurance, chequebook, and demat account, even though I had not revealed to them that I invest in Equity.

The CC does not support UPI. It is not life time free, but I can waive the annual fee by spending 1 Lakh. The joining fee is compensated through an equal amount voucher. I will ditch it before completing a full year, so I do not care much about it anyways. Best thing is that the banking application works perfectly on my de-googled device.

Becoming A Double Equity Lakhpati (19)

(2025-07-02) I am announcing this while being sleep deprived from not being able to control laughter, research. I reached 1.5L in equity at just few months into 19 and just 4.5 months after I reached 1L in equity.

Honestly I am myself surprised how did I reach this early. But it can be said it was because this is a “dividend and quarterly results” season.

Good quarterly results, ex-dates pump up the stock price, at which I sold some at a very strong profit. Then I bought some at a strong discount during the bear market caused due to Israel, Iran war.

A small cap, multibagger I bought at discount when volumes dropped after a pump and dump happened.

Well now I should probably take a break from stock market, and focus on other stuff such as increasing my credit score, college exams.

A slight less in MP is due to everyday market volatility. Markets had not opened at time of screenshot, hence day P/L is zero. If I wanted, I could take a screenshot when it is directly at goal, but I want to be honest.

Discussion On My Strategy

I do not consider myself as a long term investor as I regularly rebalance my portfolio, even if it means taking strategic losses to free up capital for better investment. At 17, I liquidated all my ETFs investments.

I mostly do not do intraday trading. I did some at 18 to gain capital to reach my goal. While I usually wait for delivery, but If is a significant increase in my positions(intraday holdings) I sometimes sell it.

The strategy which I invest my most time, enjoy the most is fundamental analysis. I have a ever growing list of sectors to avoid, which has saved me from many bad investments.

Some of those sectors include which I have no knowledge of. Vice sectors like tobacco, alcohol, gambling due to high regulations, low margins, limited customer base, commoditized, informal nature. I hold a single bank's stock in low quantity as a hedge. Because they all react the same to RBI regulations. NIFTY, SENSEX are already oversaturated by banks. I then look for good companies in sectors I invest in, and have knowledge of.

Some of red flags to me are: high debt, high PE, low promoter/insiders(especially for small, midcap), and FII/DII holdings, low OPM, very high or zero dividend payouts, high net profit yet low operating profit, low free cash flow.

I do some technical analysis as well, but it comes in the end after I have picked the stock. I basically employ to determine a right time to enter, exit. I then use GTT to because I can not monitor stock prices all the time. Some indicators I use are: RSI, Volume, Moving averages, and sometimes candle stick patterns.

I do not invest into folllowing: commodities, crypto, T-bills, mutual funds, penny stocks. I might in future diverisfy into Real estate, bonds.